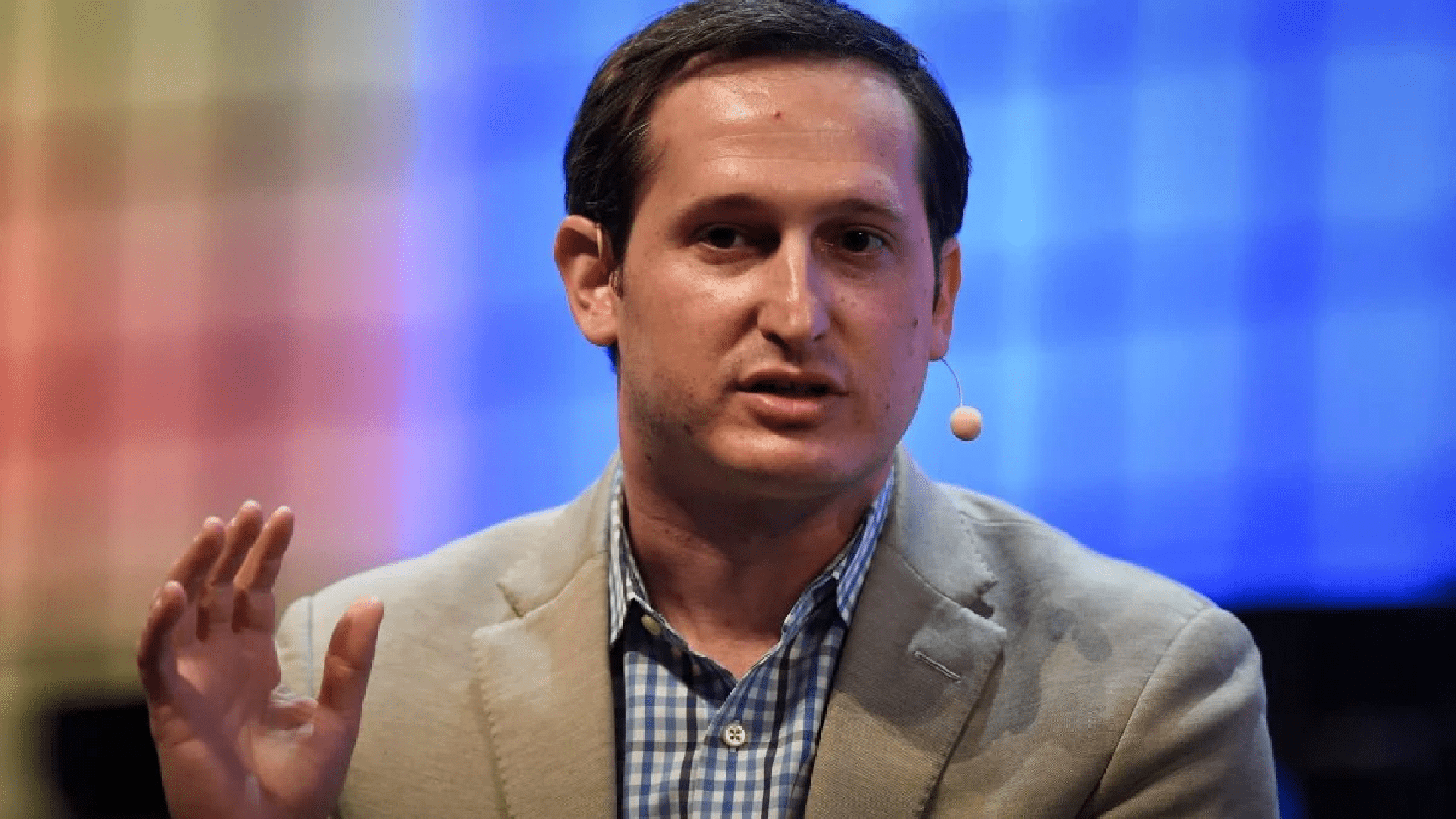

DraftKings (NASDAQ: DKNG) co-founder and CEO Jason Robins is quite unhappy with Illinois’ recent rise in sports betting taxes, describing it as “incredibly poorly thought out.”

During a CNBC interview earlier today, Robins criticized the state's second increase in online sports betting within a year, emphasizing that the newly enacted law requires a charge of 25 cents on an operator's initial 20 million booked bets and 50 cents for any additional bets. He claims that this jeopardizes the operator's capacity to function and generate profits in the state, and the sole way to achieve that is by transferring the expenses to bettors.

"It just makes no sense. It was done in the dead of night,” Robins told CNBC. “We had no warning. We actually met with legislative leaders in the weeks before the budget was released and they made no mention of this.”

DraftKings and competitor Flutter Entertainment (NYSE: FLUT), which owns FanDuel, reacted to the tax hike in Illinois by revealing a charge of 50 cents for every bet. Starting September 1, bettors will cover those costs, but both companies promised to eliminate the fees if an agreement can be made with Illinois lawmakers.

At first glance, Illinois’ recent rise in sports betting taxes appears neutral to issuers; however, similar to the progressive tax system enacted last year, DraftKings and FanDuel will bear the most significant impact.

However, as Robins mentioned in the interview, smaller operators must also pay a tax of 25 cents per bet on their initial 20 million wagers and 50 cents per bet for any wagers thereafter. Although some may not impose surcharges similar to DraftKings and FanDuel, Robins thinks Illinois bettors might turn to the black market or wager excessively to offset the transaction fees.

“Say somebody wants to make a bet of $1. The actual profit margin on that bet is probably about 10 cents,” detailed Robins. “You’re (an operator) getting charged 50 cents plus a tax on the 10 cents. Even at $10, the math doesn’t really work. You have to pass some of that along to the consumer. Otherwise you can’t take that bet no matter what your size and scale is.”

In Illinois, where 50 tax hikes have been enacted since Gov. J.B. Pritzker (D) took office in January 2019, Robins mentioned that education is necessary as some politicians might not realize that the latest tax increase does not apply to profit or revenue. Instead, it’s utilized for total revenues.

Analysts and industry experts agree that other states are unlikely to adopt Illinois' tax system for each bet, but many may increase their sports betting taxes. Along with Illinois, Louisiana and Maryland have accomplished this this year, and Massachusetts, New Jersey, and North Carolina may become part of that group.

Robins highlighted that these increased rates might lead to unforeseen effects, like hindering product innovation, ultimately affecting the consumers negatively.

“It’s (tax increases) going to drive activity to the illegal market that pays no taxes, provides no consumer protections. Easy for minors to get on and bet. All sorts of things we don’t want that was the exact purpose of legalizing and regulating this industry in the first place,” the DraftKings chief executive said to CNBC.